Good morning,

Today’s edition focuses on a key housing finance milestone and what it signals for Nigeria’s real estate market going into 2026. Strong disbursement numbers point to renewed activity across mortgages, construction finance, and affordability programs, but they also raise questions about sustainability, access, and execution at scale.

Beyond the headline figures, we look at what this momentum means for developers, homebuyers, and policymakers as housing demand continues to outpace supply.

Let’s get into it.

FMBN Exceeds Q4 2025 Targets, Disbursing ₦48.4 Billion in Landmark Housing Finance Milestone

The Federal Mortgage Bank of Nigeria (FMBN) has achieved a significant operational milestone by surpassing its fourth-quarter (Q4) 2025 financial inclusion targets. During a high-level performance assessment of the Presidential Priorities and Ministerial Deliverables held in Abuja, the bank revealed an actual performance of ₦48.4 billion in housing-related financing. This figure significantly exceeds the ₦25 billion benchmark established by the Central Results Delivery Coordination Unit (CRDCU), marking a nearly 100% over-performance in the quarter.

Dalio: “Stocks Only Look Strong in Dollar Terms.” Here’s a Globally Priced Alternative for Diversification.

Ray Dalio recently reported that much of the S&P 500’s 2025 gains came not from real growth, but from the dollar quietly losing value. Reportedly down 10% last year!

He’s not alone. Several BlackRock, Fidelity, and Bloomberg analysts say to expect further dollar decline in 2026.

So, even when your U.S. assets look “up,” your purchasing power may actually be down.

Which is why many investors are adding globally priced, scarce assets to their portfolios—like art.

Art is traded on a global stage, making it largely resistant to currency swings.

Now, Masterworks is opening access to invest in artworks featuring legends like Banksy, Basquiat, and Picasso as a low-correlation asset class with attractive appreciation historically (1995-2025).*

Masterworks’ 26 sales have yielded annualized net returns like 14.6%, 17.6%, and 17.8%.

They handle the sourcing, storage, and sale. You just click to invest.

Special offer for my subscribers:

*Based on Masterworks data. Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

FCTA Commences Enforcement of Ground Rent and Land Use Fee Collections

The Federal Capital Territory Administration (FCTA) has announced a rigorous enforcement drive to recover outstanding Ground Rent, Certificate of Occupancy (C of O) charges, and other land-use fees. Minister of the Federal Capital Territory, Nyesom Wike, confirmed the directive on 15 January 2026, stating that the administration will no longer tolerate the non-payment of statutory dues by property owners within the capital city.

FX MARKET SNAPSHOT

USD > NGN | 1,472.26 | Up by 0.44% |

GDP > NGN | 1,970.15 | Up by 0.03% |

EUR > NGN | 1,709.75 | Up by 0.01% |

CAD > NGN | 1,060.02 | Up by 0.06% |

Economy Watch

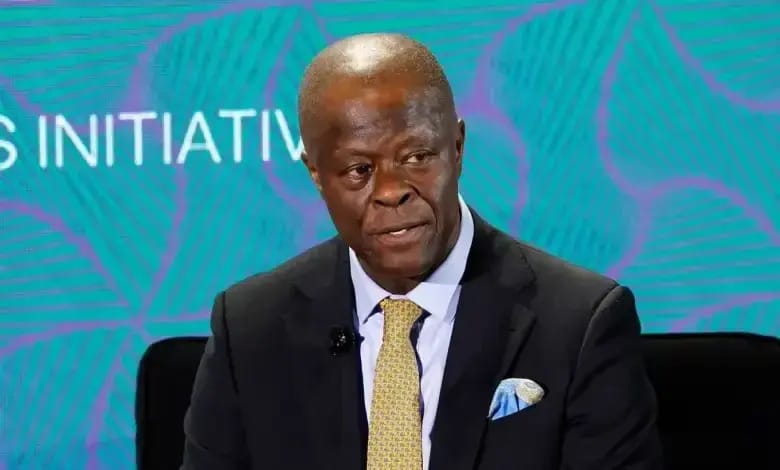

Finance Minister Wale Edun Projects Lower Borrowing Costs Amid Cooling Inflation

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has indicated that a cycle of interest rate cuts may be on the horizon if Nigeria's inflation continues its current downward trajectory. Speaking during an interview at the Abu Dhabi Sustainability Week, Edun noted that such a shift would significantly lower debt-servicing costs and provide much-needed fiscal breathing room for the federal government. The signal follows a period of aggressive monetary tightening by the Central Bank of Nigeria (CBN), which has successfully reined in the record-high inflation levels seen in late 2024.

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

Global Macroeconomic Factors Set to Influence Nigeria’s Economy in 2026

The Nigerian economy faces a complex array of global macroeconomic shifts in 2026, ranging from volatile commodity prices to evolving monetary policies in advanced economies. Analysts identify international crude oil demand, geopolitical tensions in Eastern Europe and the Middle East, and the shifting investment appetite of the Federal Reserve as the primary external drivers that will dictate Nigeria’s fiscal stability and exchange rate performance throughout the year.

As the Federal Government of Nigeria pursues a $1 trillion Gross Domestic Product (GDP) target, the interplay between domestic reforms and global headwinds remains a critical focal point for policymakers and investors.

Nigerian Mid-Tier Banks Explore Mergers as 2026 Recapitalisation Deadline Nears

Nigerian mid-tier banks have accelerated merger and acquisition (M&A) discussions as the industry enters the final quarter of the Central Bank of Nigeria’s (CBN) two-year recapitalisation window. With the 31 March 2026 deadline approaching, several lenders that have yet to secure the required minimum paid-up capital are exploring strategic combinations to avoid regulatory sanctions or license downgrades.

In March 2024, the CBN announced a significant upward revision of minimum capital requirements: ₦500 billion for banks with international authorisation, ₦200 billion for national banks, and ₦50 billion for regional institutions. While Tier-1 lenders like Access Bank, Zenith Bank, and GTBank have already crossed these thresholds through rights issues and public offers, smaller players face a more challenging path due to market concentration and rising operational costs.

Understanding the FG’s Stance on Proposed Amendments to National Tax Laws

The Federal Government of Nigeria has clarified that the proposed alterations to the country’s tax framework are corrective measures rather than wholesale changes, ensuring the core integrity of existing tax laws remains intact. Officials stated on Thursday, 15 January 2026, that the legislative refinements currently under review are intended to streamline administration and eliminate ambiguities without disrupting the broader fiscal landscape or significantly altering the tax burden on businesses.

The clarification comes as the National Assembly evaluates the Tax Reform Bills, which have sparked debate regarding their potential impact on sub-national revenue sharing and corporate compliance requirements. The executive branch maintains that these "minor changes" are essential to modernise the system and align it with global best practices in digital economy taxation and transparency.

Quote of the day:

“Progress is built by those who focus on what can be done, not what stands in the way.”

Sector Watch Monday

Regulatory Alert: 244 Businesses and Religious Centre’s Sealed in Lagos

The Lagos State Government, through the Lagos State Environmental Protection Agency (LASEPA), shut down 244 establishments across the state in 2025 for various environmental and regulatory infractions. The affected entities include hotels, churches, mosques, bars, and industrial facilities that failed to comply with state laws regarding noise pollution and environmental standards.

According to official data released by the agency, the enforcement actions were part of a year-long campaign to ensure adherence to the Lagos State Environmental Management and Protection Law. The government maintains that these measures are necessary to safeguard public health and restore environmental order within the metropolitan area.

Produced by: Amarachi Okeke

Want to get involved with NHM?

Have a confidential news tip or story idea? Email [email protected]

Want to advertise to our readers? Click here to learn more

Someone forwarded this to you? Join the list and subscribe here.