Happy weekend, everyone. 🌞

Today’s edition is packed with stories that show how housing is shifting both at home and around the world. In Lagos, Detty December is exposing a clear backlash against runaway short let prices, as more travellers quietly move back to hotels and start questioning the real value on offer. In Nigeria’s finance space, fresh details from the EMAAR saga highlight how easily unregulated “real estate investments” can turn into costly Ponzi traps for everyday investors.

Globally, the picture is just as revealing. First time buyers in the UK are finally catching a small break as financing becomes slightly more favourable. At the same time, governments in the UK and Toronto are rolling out or proposing higher taxes on very expensive homes, a sign that luxury property is increasingly in the crosshairs of policy and politics.

Let’s get into it. 🏡📊

Detty December Costs Push Visitors Back to Hotels in Lagos

Lagos is entering one of its busiest holiday seasons, but this year’s Detty December is coming with an unexpected twist. Travellers are walking away from short let apartments in large numbers, calling the prices unreasonable, ridiculous, and no longer worth the hassle.

Across Lekki, Victoria Island, and Ikoyi, short let operators have sharply increased rates ahead of the annual influx of diaspora visitors and holidaymakers. Instead of the usual surge in bookings, many Lagosians say they are choosing hotels, suggesting that the city’s once booming short let market may be overheating.

Fake Real Estate Platform EMAAR Allegedly Scams More Than 4,000 Nigerians

A new investment scandal is emerging in Nigeria after thousands of people reported losing money to a platform that presented itself as a real estate investment company. The firm, known as EMAAR, is believed to have attracted more than 4,000 Nigerians before disappearing from the internet and locking communication channels in late October 2025.

EMAAR promoted itself heavily on social media and messaging platforms. It promised short term investment cycles with generous returns and encouraged investors to commit funds for periods ranging from a few weeks to several months. Many participants said they were told they would receive their capital and profits within about ten days of each investment cycle.

AG Mortgage Bank Targets One Million Mortgages by 2030

AG Mortgage Bank Plc has announced a new five year growth strategy aimed at becoming Nigeria’s largest housing finance institution by 2030. The bank unveiled what it calls a transformational plan that focuses on five priorities: organizational restructuring, building a stronger capital base, expanding mortgage access, deepening national impact and improving shareholder value.

A central part of the plan is the goal to deliver one million mortgages by 2030. This is one of the most ambitious targets seen in Nigeria’s mortgage sector in recent years and speaks directly to the country’s estimated 20 million unit housing deficit. The bank says it intends to reach a wider range of income groups and make home ownership more attainable.

FX MARKET SNAPSHOT TODAY

USD > NGN | 1,470.26 | Up by 0.51% |

GDP > NGN | 1,960.15 | Down by 0.01% |

EUR > NGN | 1,711.75 | Down by 0.02% |

CAD > NGN | 1,064.02 | Up by 0.07% |

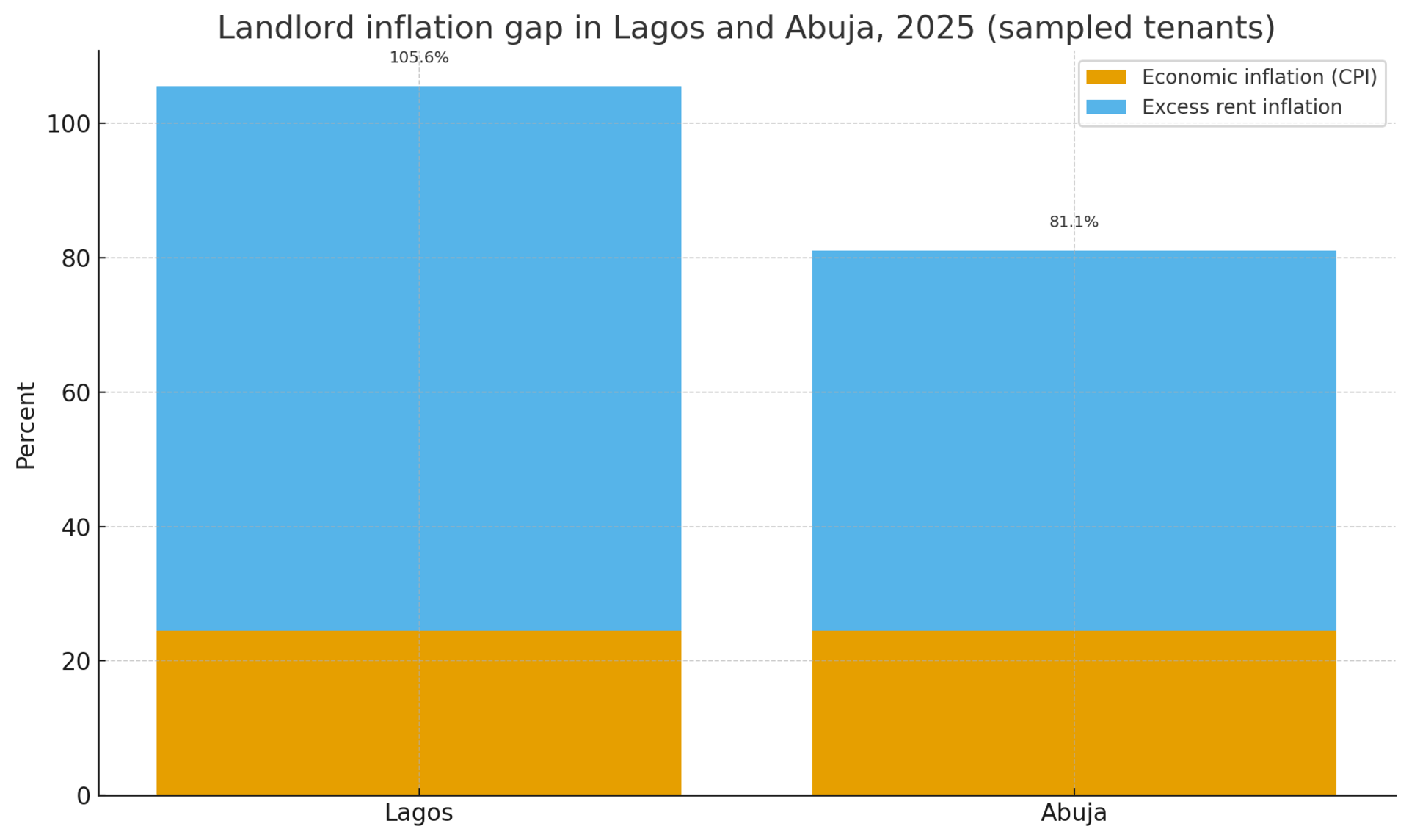

Chart of the week

Summary of the Chart

The chart shows how rent increases in Lagos and Abuja in 2025 have far outpaced general economic inflation. While economic inflation (CPI) is around 24 percent in both cities, sampled tenants reported total rent increases of about 105.6 percent in Lagos and 81.1 percent in Abuja. This means landlords are raising rents three to four times faster than the broader economy, creating a significant landlord inflation gap and placing heavy pressure on urban renters.

Quote of the day:

“The future depends on what you do today.” — Mahatma Gandhi

🌍 Global Housing Market Highlights

🇬🇧 UK: First-time buyers finally catching a break

New data shows first-time homebuyers in the UK are in their strongest position in nearly ten years. Even though home prices are high, mortgage rates have eased slightly and income conditions have improved. This has made buying a home more achievable for many young buyers again.

What this means globally: Financing conditions are becoming more influential than raw property prices. In many markets, small shifts in mortgage rates can unlock demand even when housing is expensive.

🇺🇸 Miami: Foreign buyers dominate new luxury developments

More than half of all new construction homes sold in Miami over the past two years were bought by foreign investors. Many paid in cash, which has kept luxury demand strong despite higher borrowing costs.

What this means globally: Global capital is reshaping major cities. Cash rich foreign buyers often drive up demand for new builds, creating a widening gap between local incomes and luxury property prices.

🇬🇧 UK: New annual tax on high value homes begins in 2028

The UK will introduce a yearly surcharge on properties valued above two million pounds starting in 2028. The tax targets a small fraction of homes but signals a broader shift toward heavier taxation of luxury real estate.

What this means globally: Governments in advanced markets are turning to luxury property taxes to raise revenue and address inequality. This may influence where wealthy buyers choose to invest next

🇨🇦 Toronto: City proposes higher tax on luxury home sales

Toronto is considering raising its land transfer tax for homes priced above three million Canadian dollars. Supporters say it will boost city revenue, while critics warn it could cool the luxury segment and redirect buyers to other regions.

What this means globally: High end buyers may shift toward cities with lighter tax policies. Luxury taxation is becoming a major factor in how global investors pick markets.

HAVE A GREAT DAY 😃

Produced by: Amarachi Okeke

Want to get involved with NHM?

Have a confidential news tip or story idea? Email [email protected]

Want to advertise to our readers? Click here to learn more

Someone forwarded this to you? Join the list and subscribe here.