Good morning,

Can you believe we are already in December? The year has moved quickly, and the housing market has stayed just as active. This past week brought a mix of policy moves and market signals, from demolitions in Lagos to Dangiwa urging states to allocate 1 to 3 percent of their budgets to proper land titling. We also saw the FCTA move to enforce against more than 1,000 properties over ground rent defaults, a reminder that compliance is becoming a much bigger part of the real estate conversation.

On the economy side, inflation concerns, new power sector funding, and ongoing fiscal reforms continue to shape the environment for developers, investors, and everyday buyers.

Let’s get into the stories shaping the market right now.

Lagos Government Intensifies Demolition of Illegal Structures

The Lagos State Government has expanded its enforcement drive against unapproved and unsafe buildings with a new round of demolitions in the Ikate Elegushi community and along the Lekki–Ikoyi corridor, targeting properties that violated planning regulations, encroached on public infrastructure, and posed risks to residents.

During the operation, the Lagos State House of Assembly reaffirmed its commitment to stricter oversight of the state’s rapidly growing built environment.

Alh. Dangiwa Urges States to Dedicate 1–3% of Annual Budgets to Land Titling

The Minister of Housing and Urban Development, Ahmed Dangiwa, has called on State Governments to allocate between one and three percent of their annual budgets to land administration and systematic titling, arguing that credible land governance is central to Nigeria’s ambition of building a $1 trillion economy. He made the statement in Kano at the opening of the thirtieth Conference of Directors of Lands in federal and state institutions.

FCTA Begins Enforcement Against 1,095 Property Owners for Ground Rent Defaults

The Federal Capital Territory Administration has begun enforcement actions against 1,095 property owners in Abuja for failing to pay required land charges. These charges include ground rent, certificate of occupancy fees, and payments for land use conversion.

The affected properties are located in Asokoro, Maitama, Garki and Wuse. Authorities said multiple notices were issued between May and November, but many owners still did not comply. After the final deadline passed, the Minister of the Federal Capital Territory approved immediate enforcement.

FX MARKET SNAPSHOT

USD > NGN | 1,440.32 |

GDP > NGN | 1,934.55 |

EUR > NGN | 1,695.70 |

CAD > NGN | 1,046.16 |

Economy Watch

World Bank Warns Nigeria’s Persistent Inflation Threatens Poverty Reduction and Economic Recovery

The World Bank has highlighted Nigeria’s persistently high inflation as a major impediment to economic recovery, cautioning that household incomes are being eroded and poverty rates could rise unless decisive measures are taken. Mathew Verghis, Country Director for Nigeria, stressed that inflation, particularly in food prices, disproportionately affects low-income households and undermines purchasing power nationwide.

Why It Matters: High inflation reduces the spending power of households, making it harder for people to afford rent, mortgages, and even basic home maintenance. As more Nigerians feel this pressure, demand for housing may slow, construction costs may rise, and real estate investments become riskier.

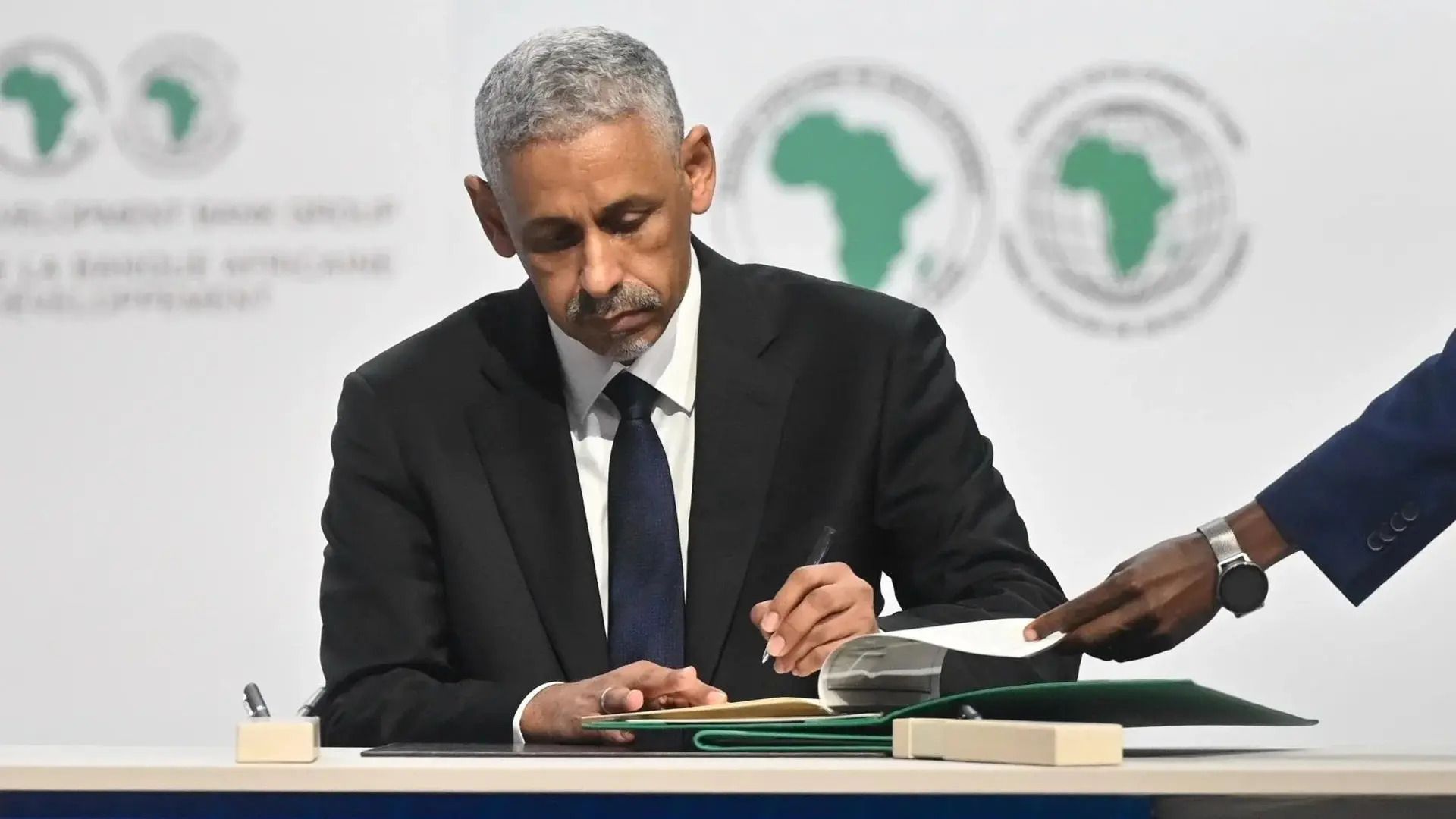

Nigeria Secures 500 Million Dollar Boost for Power Sector and Fiscal Reforms

The African Development Bank has approved a 500 million dollar loan for Nigeria to support the second phase of its Economic Governance and Energy Transition Support Programme. The loan is designed to strengthen economic management, improve the energy sector, and help Nigeria advance its climate goals.

Why It Matters: Stable power is one of the biggest factors that determines the real cost of building and living in Nigeria, so a $500 million boost to the power sector could ease pressure on developers and households. Better electricity and stronger fiscal reforms can make properties more valuable, reduce running costs, and improve investor confidence.

Quote of the day:

“In every market cycle, the winners are the ones who stay informed and act with clarity.” - Warren Buffett

Sector Watch Monday

1. Mortgage Sector: Weak Performance Still Limiting Homeownership

Nigeria’s mortgage sector continues to underperform, with advocates warning that access to affordable home loans remains extremely limited. High interest rates, short tenors, and slow reform are keeping many potential buyers locked out of the market.

2. Market Transparency / Data Integrity: 59,000+ Duplicate Listings Exposed

A recent audit by Oikus a Prop-Tech company revealed that nearly 60 percent of sampled online property listings were duplicates, exposing how unreliable and inflated digital inventory has become. This lack of accurate data makes it harder for buyers and investors to judge true supply and pricing.

3. Sustainability: Developers Still Largely Silent on Climate Impact

New reporting shows that many real estate developers have no public sustainability commitments despite rapid estate expansion. Heavy reliance on diesel power and low transparency around emissions continue to raise long-term environmental and operational concerns.

4. Housing Supply: Push to Recruit 500 Builders and Developers

A construction-focused firm Homes on Demand, announced plans to recruit over 500 builders and developers nationwide to strengthen construction capacity. The initiative aims to address persistent housing shortages and speed up project delivery timelines.

Produced by: Amarachi Okeke

Want to get involved with NHM?

Have a confidential news tip or story idea? Email [email protected]

Want to advertise to our readers? Click here to learn more

Someone forwarded this to you? Join the list and subscribe here.